Operational battery storage capacity in the US grew by 7.9 GW last year, bringing the country’s total cumulative installed base to 17 GW by the end of 2023.

The figures have been released by trade group American Clean Power Association (ACP), which released its annual report on statistics and trends in the solar PV, energy storage and wind industries earlier this month.

The country’s energy storage sector connected 95% more storage to the grid in terms of energy capacity in 2023 than the 4GW ACP reported coming online in 2022 in its previous Annual Market Report.

In more precise terms, and with megawatt-hour figures included, 7,881 MW of new storage facilities and 20,609 MWh of new storage capacity were deployed during the year.

Cumulative production and battery storage capacity installed in the US have reached 17,027 MW and 45,588 MWh, respectively. That meant an 86% increase in cumulative installed capacity in megawatts (power) and an 83% increase in cumulative installed capacity in megawatt-hours (energy).

Second consecutive record year

Meanwhile, the levelized cost of a 4-hour battery energy storage facility participating in energy markets in the US was found to be in a range between US$126 and US$177/ MWh. In 2015, the levelized cost of such a battery energy storage system (BESS) would have been between $347 and $739/MWh, although nine years ago not many systems of that duration were installed in the United States.

The average levelized cost of a solar plus storage installation was $81 to $153/MWh. In an article for Energy-Storage.news Premium published last week, several industry figures commented on the drop in BESS prices and the impact they will have.

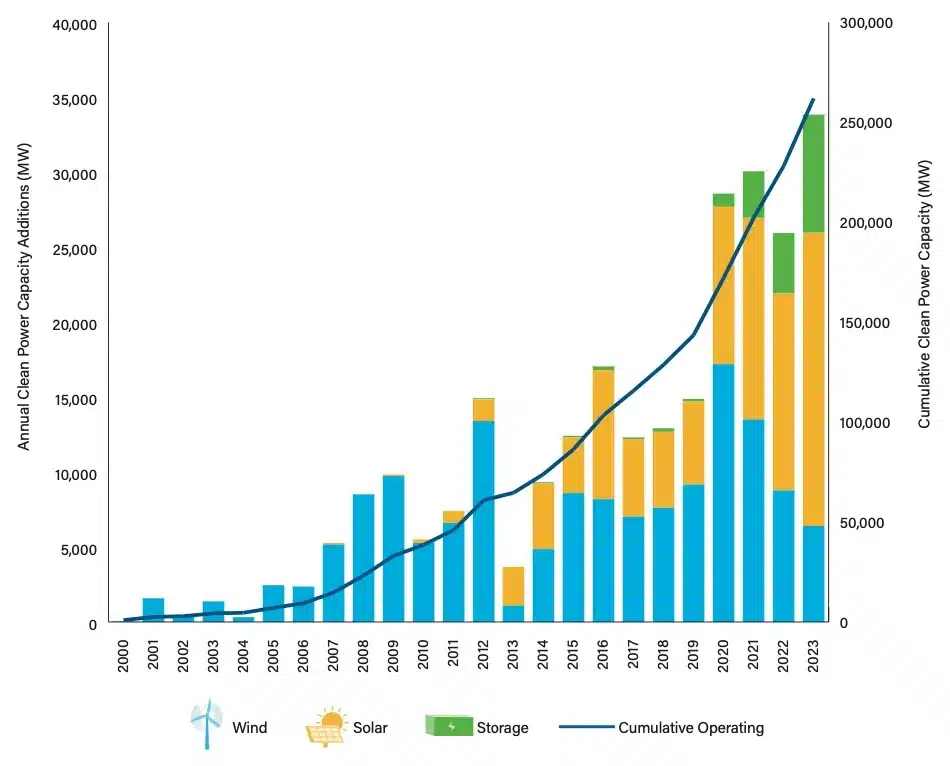

As our colleagues at PV Tech reported last week, the ACP report also highlighted that 2023 was a big year for renewables, with 33.8 GW of new installations, of which 20 GW were solar PV. In fact, wind and solar PV accounted for 77% of new large-scale energy additions, far surpassing natural gas, of which 8,999 MW, or 20% of the total, were deployed last year.

However, a challenging aspect of solar PV development is continued delays in new projects, with utility-scale solar accounting for 70% of the more than 60 GW of clean energy capacity that had been planned. delayed to the end of 2023. Of that figure, 38GW were projects that did not meet the original COD deadlines during the last year and the rest were delayed from previous years.

Battery storage was not immune to delays, but it was the least affected of the three technologies, accounting for only 12% of total delays. This is perhaps due to the fact that photovoltaic solar energy has also been subject to international trade problems in recent years due to the import of modules from abroad, mainly from China.

In total, it was a second consecutive record year for the US battery storage industry, with 2022 up 80% in megawatts and up 93% in megawatt-hours in cumulative installations over 2021, ACP said.

ACP CEO Jason Grummet said 2023 had been a “banner year” for solar and energy storage, and also noted the growth in investment in clean energy manufacturing that the United States has enjoyed since the approval of the Inflation Reduction Act (IRA).

While only two manufacturers in the nascent battery storage manufacturing sector supplied modules or packs to the industry in 2023, ACP expects 20 new facilities to come online by 2030.

Most of them will support the manufacturing of battery cells and modules, the trade group said. In August last year, ACP said $270 billion in clean energy investments had already been committed to downstream and manufacturing projects since the passage of the IRA.

Energy-Storage.news publisher Solar Media will host the 6th US Energy Storage Summit this week, March 19-20, 2024, in Austin, Texas. With a program packed with panels, presentations and fireside talks from industry leaders focused on accelerating the energy storage market across the country. For more information, visit the website.